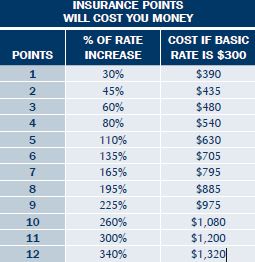

When you are considered a “High Risk” in North Carolina your rates could soar quickly.

NC Assigned or High Risk Car Insurance, each insurance company initially is allowed to refuse to sell insurance to any driver, except for reasons prohibited by antidiscrimination laws. Drivers who are initially unable to buy insurance may appeal to an organization that assigns such drivers to insurance companies in proportion to company market share. Each company is required to sell insurance to its assigned drivers, for which the company receives premiums, pays claims, and provides service.

Get A North Carolina High Risk Car Insurance Quote. Buy Online and save money!

Other options may also be available to you as well.

North Carolina High Risk Car Insurance help and NC High Risk Truck, Bus and Commercial Auto is available in the following metropolitan area and suburbs in the Tarheel State. ( Help is available in every NC town)

Asheville | Cary | Charlotte | Durham | Fayetteville | Gastonia | Greensboro | Greenville | Hickory | High Point | Jacksonville | Raleigh | Wilmington | Winston‑Salem Albemarle | Apex | Asheboro | Burlington | Chapel Hill | Concord | Eden | Elizabeth City | Goldsboro | Graham | Havelock | Henderson | Hendersonville | Kannapolis | Kings Mountain | Kinston | Laurinburg | Lenoir | Lexington | Lumberton | Monroe | Morganton | New Bern | Newton | Reidsville | Roanoke Rapids | Rocky Mount | Salisbury | Sanford | Shelby | Statesville | Thomasville | Waynesville | Wilson Boone | Carrboro | Clayton | Cornelius | Dunn | Fuquay-Varina | Garner | Harrisburg | Holly Springs | Hope Mills | Huntersville | Indian Trail | Kernersville | Knightdale | Matthews | Midland | Mint Hill | Mooresville | Morehead City | Morrisville | Mount Pleasant | Oxford | Smithfield | Southern Pines | Tarboro | Wake Forest

[schema type=”product” url=”https://assignedriskauto.com/north-carolina-high-risk-car-insurance/” name=”NC High Risk Car insurance” description=”Get fast help finding North Carolina car insurance coverage, quote, compare, bind and get ID card.” single_rating=”4.94″ agg_rating=”61″ condition=”New” ]